文丨陈达飞(东方证券财富研究中心总经理、博士后工作站主管)

当地时间8月26日,美联储主席鲍威尔在全球瞩目的杰克逊霍尔央行年会上,发表了个人认为是年度最“鹰”的一次讲话,甚于6、7月例会,美股闻讯大幅回撤。

鲍威尔认为,当前的主要矛盾仍是通胀,他首先是担心“紧缩不足”,其次才是“过度紧缩”。这次会议中提到的“三个教训”,一是向市场传递信心,美联储可以实现低且稳定的2%通胀目标;二是强调通胀预期发挥的“锚”的作用,联系到了工资-物价螺旋,因为劳动力市场依然非常紧张;三是明确了“紧缩不足”的风险。如果市场领会了鲍威尔的意思,长期通胀预期会进一步下行,或至少会保持在略高于2%目标的水平上,而不会脱锚。

以下是鲍威尔讲话的全文、翻译和笔者的评议。

1. Thank you for the opportunity to speak here today.

谢谢给我今天在这里演讲的机会。

2. At past Jackson Hole conferences, I have discussed broad topics such as the ever-changing structure of the economy and the challenges of conducting monetary policy under high uncertainty. Today, my remarks will be shorter, my focus narrower, and my message more direct.

在以前的杰克逊霍尔会议上,我讨论的话题很广泛,比如不断变化的经济结构,以及在高度不确定的环境中实施货币政策的挑战。今天,我的讲话将会更简短,重点更集中,信息更直接。

3. The Federal Open Market Committee's (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all. The burdens of high inflation fall heaviest on those who are least able to bear them.

联邦公开市场委员会(FOMC)目前的首要任务是将通胀降到2%的目标水平。物价稳定是美联储的职责所在(注:写进了《联邦储备法案》),也是我们经济平稳运行的基石。没有价格稳定,经济的运行对任何人来说都将是不合意的。特别是,如果没有价格稳定,我们将无法恢复有利于所有人的、持久的和强劲的劳动力市场。高通胀最沉重的负担将会落在那些最无力承受的人的身上。

评议:美联储的货币政策现在非常关注分配与公平。

20世纪70年代中期以来,美国贫富分化问题日渐突出。这在收入流量与财富存量分配格局中都有体现。一般认为,其原因主要是结构性的——技能偏好性技术进步、经济的全球化和金融化、市场集中度和企业议价能力的提升、数字经济的“赢家通吃”特征等。长期以来,美联储货币政策目标并未明确包含分配的维度,但越来越多的证据显示,分配格局的恶化却直接影响到“物价稳定”和“最大就业”目标的实现,因为贫富分化是导致经济长期停滞、压抑自然利率和物价水平的重要原因。所以,如何更好地调节收入分配已经成为美联储货币政策的题中之意。2008年大危机以来,量化宽松政策在托底整体经济和阻遏风险传染的同时,也会通过资产价格重估效应而加剧财富分配的不均等,这又反过来影响到经济复苏的持续性,提高货币政策面临“零利率下线”约束的长期性。所以,美联储必须考虑货币政策的分配效应。疫情冲击的特殊性在于,大量就业者退出了劳动力队伍,劳动参与率大幅下挫,这使得官方失业率显著低估了真实失业水平和失业缺口。后疫情时代,被低估的失业率和就业市场的“K型复苏”特征成为美联储退出非常规政策的“绊脚石”。

4. Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

恢复价格稳定还需要一段时间,这需要我们有力地运用货币政策工具,使需求和供应更好地平衡。为了降低通胀,经济增长速度可能在一段时间内会持续低于潜在增速。而且,劳动力市场状况很可能会有所弱化。利率的上升、经济增长速度的放缓和就业市场的疲软都会降低通胀,但也会给家庭和企业带来一些痛苦。这些都是降低通胀不幸的代价。如果不能实现价格稳定,损失会更严重。

评议:供不应求是当前通胀的成因,货币政策只能作用于需求,故只能通过收缩需求压制通胀。鲍威尔接受了压制通胀会牺牲短期经济增长的事实,但强调这是“两害相权取其轻”,算是在为后文做铺垫。

5. The U.S. economy is clearly slowing from the historically high growth rates of 2021, which reflected the reopening of the economy following the pandemic recession. While the latest economic data have been mixed, in my view our economy continues to show strong underlying momentum. The labor market is particularly strong, but it is clearly out of balance, with demand for workers substantially exceeding the supply of available workers. Inflation is running well above 2 percent, and high inflation has continued to spread through the economy. While the lower inflation readings for July are welcome, a single month's improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.

相对于2021年历史最高水平的经济增速而言——反映了大流行冲击后的经济重启,美国经济增长率开始明显放缓。虽然最新的经济数据好坏参半,但在我看来,我们的经济继续保持着强劲的动能。劳动力市场尤其强劲,但它显然是失衡的,对工人的需求大大超过了可用工人的供应。通货膨胀率远高于2%,高通货膨胀率继续在经济中蔓延。尽管7月通胀数据下降了,这令人欣慰,但单个月的下降还远不足以使委员会确信通胀的拐点已经出现。

评议:如何才能让FOMC确信通胀的拐点已经确立了?这是分析的要点,显然,7月单月的小幅下行是不满足条件的。个人认为,既要关注通胀的水平,也要关注结构、动态的路径和波动率。

6. We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent. At our most recent meeting in July, the FOMC raised the target range for the federal funds rate to 2.25 to 2.5 percent, which is in the Summary of Economic Projection's (SEP) range of estimates of where the federal funds rate is projected to settle in the longer run. In current circumstances, with inflation running far above 2 percent and the labor market extremely tight, estimates of longer-run neutral are not a place to stop or pause.

我们会确保一个足够紧缩的政策立场,以使通货膨胀下降到2%的水平。在7月的会议上,FOMC将联邦基金利率的目标区间上调至2.25 - 2.5%,这是经济预测摘要(SEP)对长期联邦基金利率区间的估计(注:即中性利率区间)。目前的特征事实是,通胀远高于2%,且就业市场极度紧张。所以,还不是停止或暂停加息的时候。

评议:加息表明货币政策趋于收紧,但不一定是过紧(或偏紧),只要FFR低于中性利率,就可以认为货币政策还处于宽松区间。可将FOMC季度预测(SEP)当中关于FFR的长期预测视为中性利率,2022年6月的最新预测为2.5%,等于7月加息后FFR目标区间的上限。这意味着,9月加息后,货币政策才从偏松转向偏紧。疫情之后,数据噪声较大,一个较为普遍的观点认为,对中性利率的估计存在较大的误差,以至于纽约联储都暂停对外发布模型的最新预测结果。实践中,可用美国国债期限结构来衡量货币政策的松紧程度,常用的指标有:3个月国库券与10年国债的期限利差(3M-10Y)、1年国债与10年国债利差(1Y-10Y)或2年国债与10年国债利差(2Y-10Y)。三个指标的走势基本一致。3M-10Y与另外两个指标短期可能出现背离,但迟早会收敛。

7. July's increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook. At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.

7月是今年第二次加息75个基点,我当时说,再来一次不同寻常的大幅度的加息可能是合适的。我们现在大约已经过了休会期的一半。9月例会的决定将取决于获得的全部数据和不断演变的前景。在某个时点,随着货币政策的立场进一步收紧,放缓加息的步伐可能是合适的。

评议:“某个时点”的确定主要取决于美联储是否确认通胀正在确定地朝着2%目标收敛。美联储内部的研究人员一般会给一个预测的通胀路径,FOMC成员会结合就业等基本面信息的预测,反推不同时点合适的货币政策立场。当然,后疫情时代预测非常不靠谱,FOMC也必须将这一点考虑进来。

8. Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy. Committee participants' most recent individual projections from the June SEP showed the median federal funds rate running slightly below 4 percent through the end of 2023. Participants will update their projections at the September meeting.

恢复物价稳定可能(还)需要在一段时间内保持紧缩的政策立场。历史的经验教训对过早地放松政策提出了强烈警告。6月的SEP显示,FOMC成员预测到2023年底联邦基金利率的中位数略低于4%。FOMC将在9月的会议上更新他们的预测。

评议:正如我在点评7月会议纪要中说的,美联储首先是担心紧缩不足,其次才是紧缩过度。

9. Our monetary policy deliberations and decisions build on what we have learned about inflation dynamics both from the high and volatile inflation of the 1970s and 1980s, and from the low and stable inflation of the past quarter-century. In particular, we are drawing on three important lessons.

我们对货币政策的审议和决策基于我们从上世纪七八十年代的高且不稳定的通胀以及过去四分之一世纪的低而稳定的通胀中对通胀的认识。值得强调的是,我们吸取了三个重要教训:

10. The first lesson is that central banks can and should take responsibility for delivering low and stable inflation. It may seem strange now that central bankers and others once needed convincing on these two fronts, but as former Chairman Ben Bernanke has shown, both propositions were widely questioned during the Great Inflation period.1 Today, we regard these questions as settled. Our responsibility to deliver price stability is unconditional. It is true that the current high inflation is a global phenomenon, and that many economies around the world face inflation as high or higher than seen here in the United States. It is also true, in my view, that the current high inflation in the United States is the product of strong demand and constrained supply, and that the Fed's tools work principally on aggregate demand. None of this diminishes the Federal Reserve's responsibility to carry out our assigned task of achieving price stability. There is clearly a job to do in moderating demand to better align with supply. We are committed to doing that job.

第一个教训是,央行能够且应该承担起实现低而稳定的通胀的责任。回看历史,以前还需要说服中央银行家们和其他人接受这两点似乎有些奇怪,但正如前主席本·伯南克所表明的那样,这两个主张在大通胀时期都受到了广泛的质疑。今天,这些问题已经解决了。维护价格稳定,我们责无旁贷。的确,目前的高通胀是一个全球现象,许多经济体都面临着高通胀压力,有的国家甚至比美国还要高。在我看来,美国目前的高通胀也是强劲的需求和受限的供给共同的结果。美联储的工具主要针对总需求。但这不会削弱美联储承担维护价格稳定任务的责任。显然,我们需要做的是缓和需求,使其与供应更好地匹配。我们正致力于此。

评议:对外安抚市场、公众,对内建立自信,给小伙伴们打气。

11. The second lesson is that the public's expectations about future inflation can play an important role in setting the path of inflation over time. Today, by many measures, longer-term inflation expectations appear to remain well anchored. That is broadly true of surveys of households, businesses, and forecasters, and of market-based measures as well. But that is not grounds for complacency, with inflation having run well above our goal for some time.

第二个教训是,公众对未来通胀的预期可以在通胀的未来走向方面发挥重要作用。当下,从许多指标来看,长期通胀预期的“锚”还在。对家庭、企业和预测机构的调查,以及基于市场的衡量标准,大致都是如此。但这不是自满的理由,通胀远高于我们的目标已经有一段时间了。

评议:通胀预期在持续高通胀的形成过程中至关重要。当前,美国的短期通胀预期明显高于长期——通胀的期限结构是倒挂的,这是美联储还能够在一定程度上去平衡短期与长期目标的原因。稳定的通胀预期能为货币政策当局提供更多跨期最优决策的空间,即不以短期目标而牺牲中长期目标。相反,通胀预期越不稳定,锚定通胀预期的成本就越高,也就越要求货币当局对短期的压力做出更积极的响应,而这可能要求牺牲长期目标。

12. If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will. Unfortunately, the same is true of expectations of high and volatile inflation. During the 1970s, as inflation climbed, the anticipation of high inflation became entrenched in the economic decision-making of households and businesses. The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions. As former Chairman Paul Volcker put it at the height of the Great Inflation in 1979, "Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations."

如果公众预期通胀将在一段时间内保持在低且稳定的水平上,那么,在没有重大冲击的情况下,实际情况很可能也会如此。不幸的是,对于高且不稳定的通胀预期也会自我实现。上世纪70年代,随着通胀的攀升,对高通胀的预期在家庭和企业的经济决策中变得根深蒂固。通货膨胀率越高,人们就越预期它还会保持在高位,他们把这种信念嵌入在工资和定价决策上。正如前美联储主席保罗•沃尔克在1979年通胀达到顶峰时说的,“通胀在一定程度上是自我反馈的,因此,要想恢复一个更稳定、生产率更高的经济,必须将一部分精力放在控制通胀预期上。”

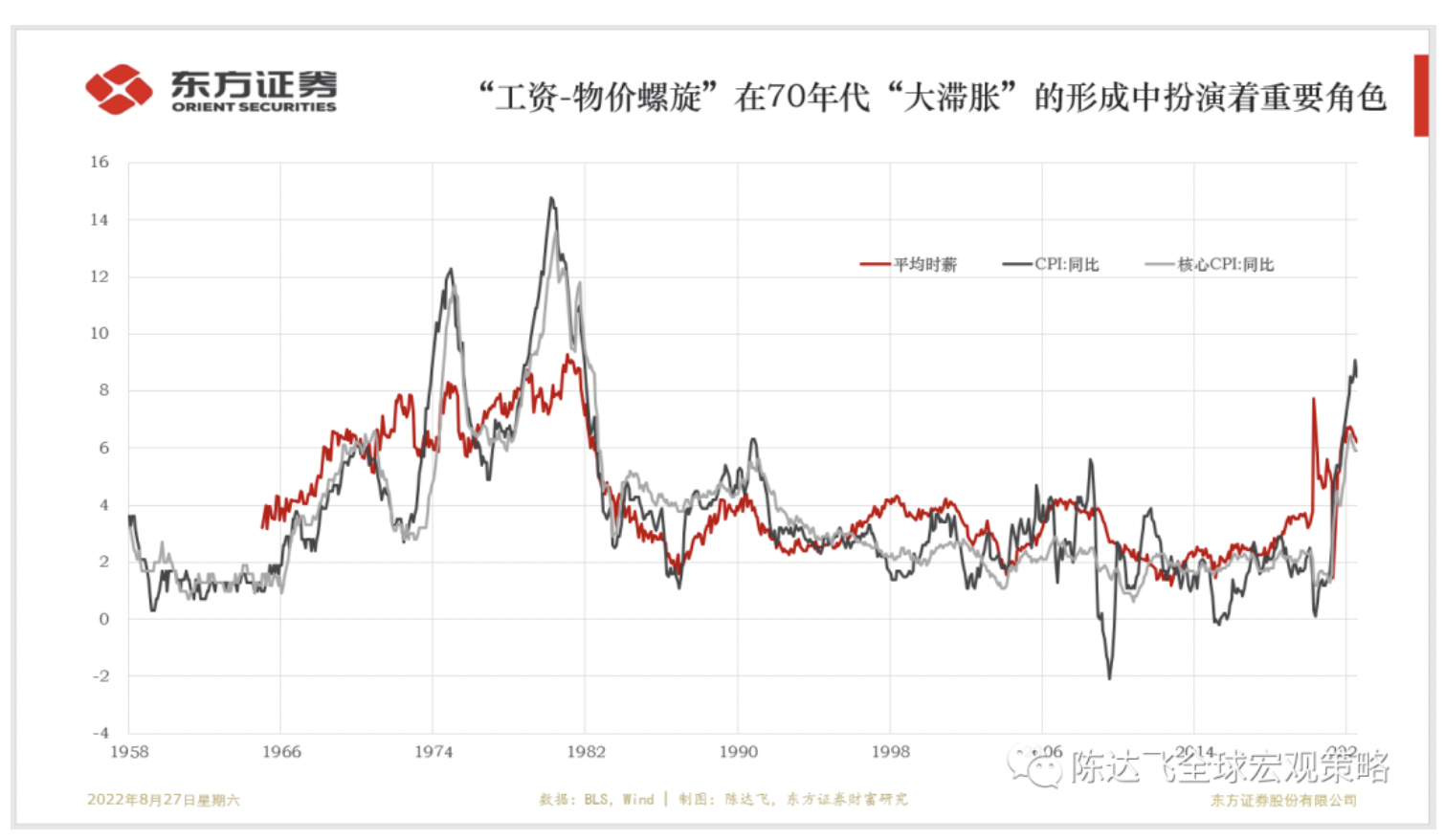

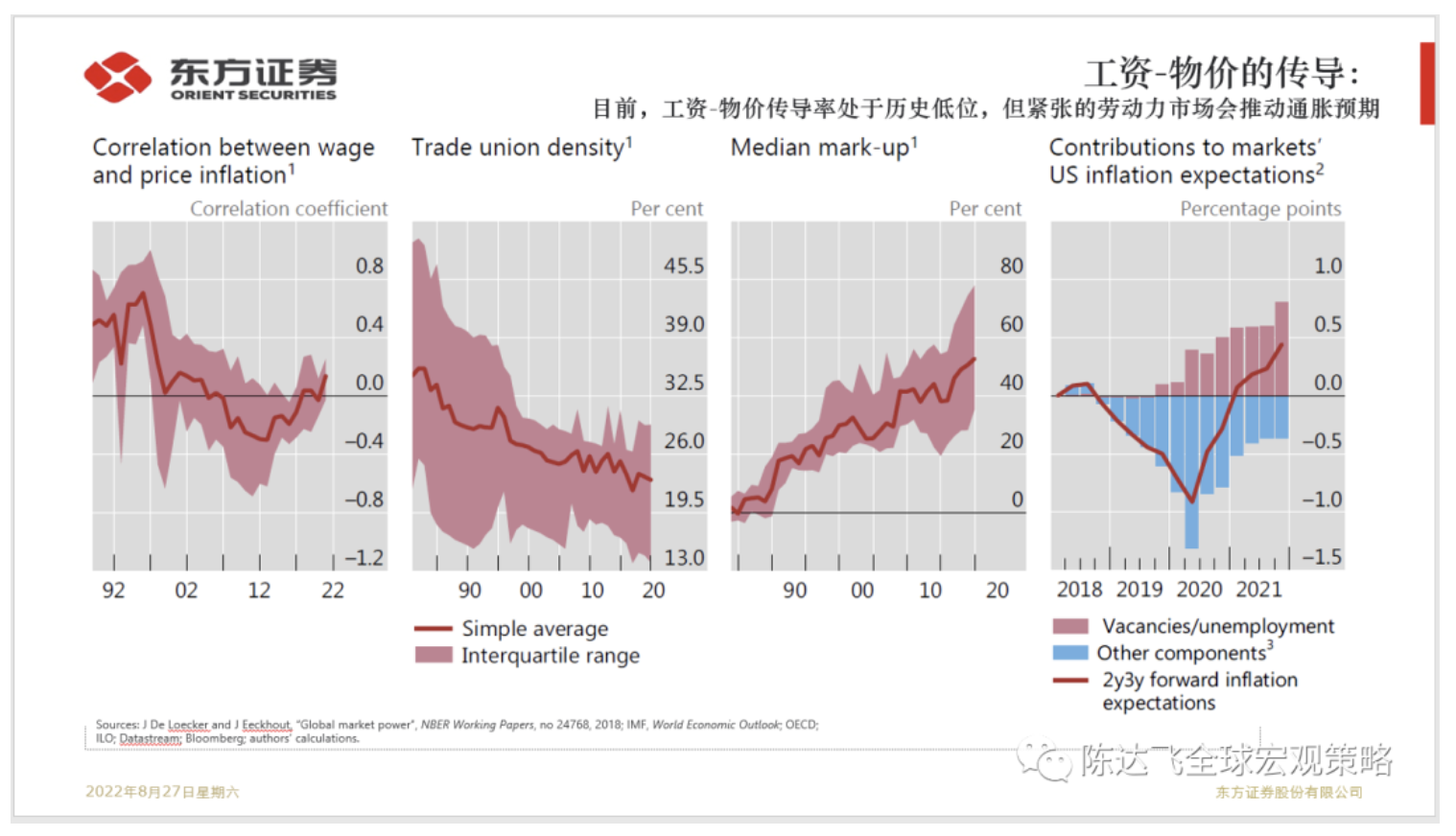

评议:通胀预期会自我实现。货币当局之所以关注通胀预期,原因是它对定价行为的影响,包括物价和工资,以及二者之间的正反馈关系。当预期通胀居高不下时,劳动者一般会要求更高的工资,或指数化的工资决定机制,比如与生活成本(Cost-of-Living Adjustment,COLA)挂钩。当企业预期到要素成本存在上行压力时,会根据议价能力和商品的需求价格弹性的大小选择将一部分成本转嫁给消费者,从而形成“工资-物价螺旋”。这是20世纪70年代“大滞胀”形成的重要原因。工资决定的是通胀的趋势,而非波动。“工资-物价螺旋”一旦形成,通胀预期就脱锚了。是货币当局最不愿意面对的环境。工资和物价都是有粘性的,“工资-物价螺旋”的形成有较高的前置条件,比如紧张的劳动力市场、较高的集体谈判权、宽松的货币政策、较高的中长期通胀预期等。“大缓和”时代以来,市场和政策制定者都习惯了通胀预期稳定或存在通胀缺口的宏观环境,忘却了“工资-通胀螺旋”的风险。直到2022年7月例会,FOMC依然否认“工资-通胀螺旋”是通胀的一个成因,当然这也是市场的共识,但不可否认风险正在积聚。

13. One useful insight into how actual inflation may affect expectations about its future path is based in the concept of "rational inattention."3 When inflation is persistently high, households and businesses must pay close attention and incorporate inflation into their economic decisions. When inflation is low and stable, they are freer to focus their attention elsewhere. Former Chairman Alan Greenspan put it this way: "For all practical purposes, price stability means that expected changes in the average price level are small enough and gradual enough that they do not materially enter business and household financial decisions."4

关于实际通胀可能会怎样影响人们对其未来走向的预期,一个有用的洞见建立在“理性忽视”的概念上。当通货膨胀持续高企时,家庭和企业必须密切关注并将通货膨胀纳入他们的经济决策。当通货膨胀处于低位且稳定时,他们可以更自由地将注意力集中在其他地方。前美联储主席艾伦·格林斯潘这样说:“从实际角度来看,价格稳定意味着平均价格水平的预期变化足够地小,足够地平滑,它们不会实质性地影响企业和家庭的金融决策。”

评议:所谓“理性忽视”,就是注意不到通胀的存在,不将其纳入到金融、经济决策行为中,例如:不要求债权人不好求更高的通胀补偿收益率,劳动者不要求更高的工资、企业不指定更高的物价等。

14. Of course, inflation has just about everyone's attention right now, which highlights a particular risk today: The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.

当然,目前几乎所有人都在关注通胀,这凸显了一种特殊的风险:高通胀持续的时间越长,对通胀上升的预期变得更加根深蒂固的可能性就越大。

15. That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

这就引出了我的第三个教训,那就是我们必须坚持下去,直到工作完成。历史表明,随着高通胀在工资和物价的制定中变得更加根深蒂固,降低通胀的就业成本可能会随着时间的延迟增加。上世纪80年代初沃尔克抗通胀的成功是在此前15年多次降低通胀的尝试失败之后发生的。为了遏制高通胀,需要长期执行非常紧缩的货币政策,以将通胀降至低而稳定的水平——这是2021年春天之前的常态。我们的目标是通过现在果断的行动来避免这样的结果(长期实施紧缩政策)。

评议:坚定信心,谨防在通胀刚刚有点下降的苗头,或者下行的趋势还不稳固的时候就理解转变紧缩的政策立场,以权衡就业/经济增长目标。

16. These lessons are guiding us as we use our tools to bring inflation down. We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.

这些经验教训在指导我们使用我们的工具来降低通货膨胀。我们正在采取有力而迅速的措施来调节需求,使其更好地与供给保持一致,并稳定通胀预期。我们将继续努力,直到我们确信完成了这项工作。

(文章仅代表作者观点。责编邮箱:yanguihua@Jiemian.com。)

评论